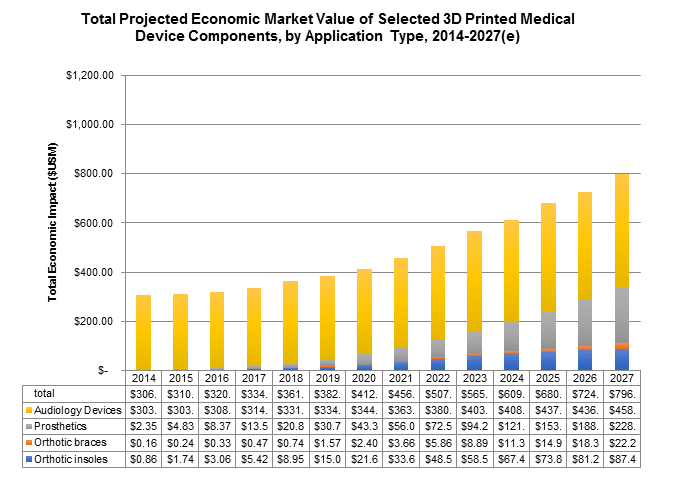

With our latest study of medical 3D printing markets, SmarTech has chose to focus on a set of interesting medical device applications which, while on the surface appear to be quite different from one another, all share one important thing in common –they can teach us very important lessons about 3D printing’s ability to potentially alter the underlying structure and supply chains of a market. Other major medical applications in 3D printing are focused specifically on surgical care. Of course, 3D printing can also effectively target medical devices which have a much greater degree of consumer interaction in the value chain, and this is where things get interesting, especially in the case of hearing aids, orthotic insoles, orthotic braces, and prosthetic devices. It’s these aforementioned devices which we’ve decided to focus on in the report.

To begin a quick comparison of 3D printing’s potential to disrupt these particular markets, let’s look into the world of hearing aids.

Hearing Aids – Minor Disruption from Underutilization of Print Technologies

Christian Sandstrom, an associate of the Ratio Institute in Sweden, produced a study of the implications of adoption of 3D printing within the hearing aid industry in late 2015 which arrived at some interesting conclusions. He proposed that, because 3D printers and related solutions were widely available at their time of adoption, and because the hearing aid industry was highly consolidated already, 3D printing had relatively little total disruptive effect on the hearing aid industry. Major players were all able to transition to producing custom hearing aid shells with printers, and because the design of the actual products stayed more or less the same, relatively little competencies were destroyed as a result.

What is interesting to note, however, is that Sandstrom also makes sure to include the feedback from leaders in the audiology industry that 3D printing technology still has quite a lot of untapped potential to offer in terms of optimizing hearing aids. Since the study’s publication, there may be mounting evidence to point to in this regard. First, Phonak has recently utilized metal additive manufacturing for the first time in commercial production of a new hearing aid shell, which allows them to make their smallest hearing aid ever with additively manufactured titanium. Though customers predominantly desire a custom hearing aid, today the majority end up with non-custom products pushed by the industry because they are higher margin. Meanwhile, more and more companies are now utilizing 3D printing to produce other elements of non-custom hearing aids, which is leading to an increased overall penetration of the technology in production as the industry as a whole has shifted to non-custom products over the last decade. The greater degree to which additive technologies can be used to produce the end product, the greater the disruptive potential to an industry.

With relatively little disruption through the adoption of 3D printing in the hearing aid industry today, but some argument to suggest it may increase in the future, let’s compare two other medical device areas which are providing significantly greater chances for major changes through use of 3D printing.

Orthotics – Major Potential for Disruption Thanks to Total Digital Solution

In the area of 3D printed orthotic insoles, another excellent study was produced in late 2016 by Dr. Simon Spooner of Peninsula Podiatry in the United Kingdom and published in Podiatry Today which compared the potential cost effectiveness and overall disruptive potential of 3D printing in the foot orthosis industry. The study suggested that there were few advantages to utilizing 3D printing for orthosis production at industrial scale compared to other digital subtractive CADCAM (milling) technologies. However, the study itself relied on previously published works from 2011 and 2012 which were based on the capabilities and cost profiles of older technology, and also acknowledged that the existing body of academic study in this regard was lacking in direct comparability. The study did however conclude that 3D printing had an interesting potential to impact the existing business model of orthotic insoles.

Today, operations such as Wiiv provide consumers with a fully digitized solution for custom orthotic insoles, allowing the consumer to utilize their own smartphone to capture key anatomical data which is then automatically converted into the necessary design for the insole, matched to the shape of the foot. The insole base is produced via powder bed fusion and shipped to the consumer for $99 a pair. Compared to existing “custom” orthotic products and how these are ultimately dispensed to consumers, what 3D printing and a fully digital solution can provide is astounding. Most truly custom orthotic insole products dispensed by podiatrists cost several hundred dollars, and require multiple visits to a podiatrist. Clearly, there is some potential for disruption not only on the basis of cost (assuming quality is comparable to traditionally made products), but also in the underlying acquisition process. Dr. Spooner begins to recognize this potential at the end of his study, noting that the role of an orthotic laboratory and podiatrist could change significantly in the future.

Prosthetics – Enormous Disruptive Potential from Radical Redesign Potential

Finally, in the area of prosthetics, 3D printing has already been shown to have the potential to be barrier-busting, with thousands of functional upper extremity prosthetic hands already having been produced and now in use with children and adults. In a video recorded by e-Nable contributor Jeremy Simon in 2014, an amputee gives his thoughts on the ~$500 3D printed prosthetic he had recently been provided with his existing solution (which, by the way, cost around $40,000). The printed device clearly provides improved functional elements with fully articulating fingers, and while most would agree that today’s printed hand prosthetics can be challenging in robust durability and continued long term function, existing prosthetics costing tens of thousands of dollars are generally accepted to only have a useful life of three to five years before they need to be replaced as well.

Use of 3D printing for prosthetics is limited today commercially, with a great focus being put on compassionate use which leverages the digital nature and disruptive cost profile of printing to get functional prosthetics to those who have simply been priced out of an existing solution. But the long term implications are clear –with the right designs and technologies, printing of prosthetics can provide a solution that no other method in the industry can. It’s only a matter of time before this is leveraged in a more commercial manner to impact markets. Currently, startups like Mecuris are already getting started producing robust, fully printed foot prosthetics using high end powder bed fusion technology to produce an entire prosthetic foot in a single part.

3D-Disruption Not Always Measured in Dollars and Cents

Looking back at these three medical device areas of application, the moral of the story is clear; medical devices can be effectively redesigned to leverage digital production via 3D printing to improve functionality, access to devices through cost reduction, or some combination of both. The greater degree to which printing can produce critical components of a device or aggregate them into a new design, the greater the disruptive potential. For now, 3D printing’s impact in these areas has been either niche based on limited commercial implementations, or largely un-disruptive because the technology is only being leveraged in the scope of a traditional approach to manufacturing (such as in the case of printing hearing aid shells). But in the future, we suspect that printing will continue to upend traditional business models in many medical device markets, with implications not only to the manufacturers of such devices, but to the broader medical community involved in their dispensation and management as well.

Source: SmarTech Publishing, Opportunities for Additive Manufacturing in Medical Devices – Prosthetics, Orthotics, and Audiology

Seen above, the total market value of printed devices from the standpoint of economic impact doesn’t tell the whole story. With 3D printing providing significant cost savings in certain device applications to include prosthetics and orthotics when leveraged in an all-encompassing way through effective design, the real disruptive impacts become measured less purely by dollars and cents, and more by how the industry structure could be impacted –from manufacturing to patient-provider care.

In order to best understand and prepare for the impacts which healthcare-related 3D printing applications are having on patient care and medical device design, SmarTech is hosting its first ever conference in conjunction with 3Dprint.com called Additive Manufacturing Strategies. To learn more about the conference and how leaders from the healthcare printing industry are leveraging 3D printing, visit https://www.additivemanufacturingstrategies.com.