3D Printing Markets Totaled $14.7B in 2023, Year Over Year Growth of 13%; AM Research Publishes Annual 2023 Market Data, Debuts Written Market Insights

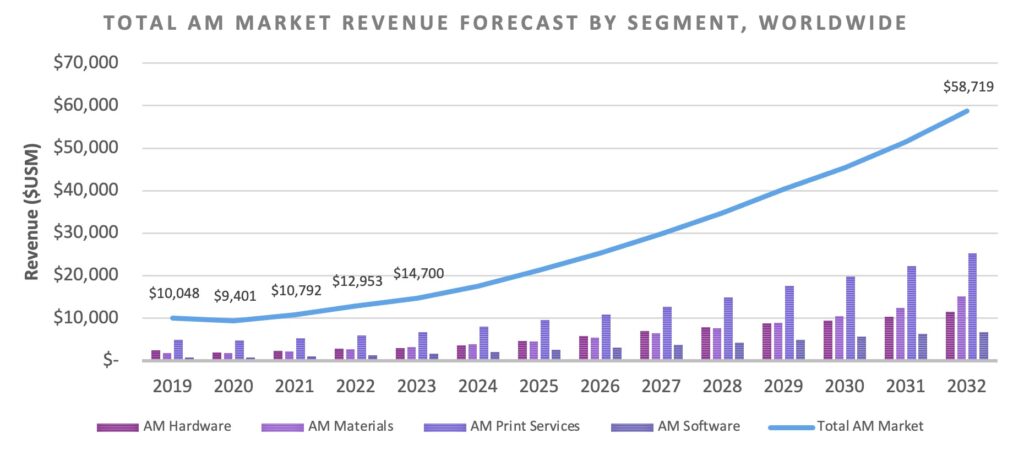

NEW YORK, NY – The fourth quarter of 2023 capped a challenging year for additive manufacturing (AM) markets, according to Additive Manufacturing Research (AM Research). Even amidst a rebound in general market sentiment, the growth rate for all 3D printing hardware, materials, software and services is estimated to be only 13.5% (to $14.7B) for 2023 compared to 2022.

The AM metals segment outpaced polymers with nearly 15% growth compared to just over 10% for polymers. The AM services market totaled $6.7B, growth nearly in line with the total AM industry. AM hardware revenues in the fourth quarter grew less than 1% as compared to the same quarter in 2022, largely reflected publicly in many earnings reports, while annually hardware revenues across both metals and polymers grew just under 6% in 2023 versus 2022.

With this Q4 2023 reporting, AM Research is debuting a quarterly “3DP/AM Market Insights” product. Written analysis is combined with proprietary charts and data tables to provide color and context to AM Research’s traditional Core Metal and Core Polymer market data products, which previously have always only been in the form of an exhaustive Excel data file.

Scott Dunham, EVP, AM Research, commented, “An abnormal, up-and-down year for the AM market ended about the same as it began – with shifting trends in system purchasing making a lot of headlines and depressing revenue growth. Still there exists a real appetite for AM technology that is likely to break loose in the near term, driven by a combination of government spending and maturity in key markets. We expect a return to normal historical growth levels this year. Longer term, AM is still the technology to watch for manufacturing evolution.”

Companies included in AMR’s Core Metals and Core Polymers tracking data and 3DP/AM Market Insights report include but are not limited to: 3D Systems, Stratasys, Markforged, Desktop Metal, Velo3D, Nikon SLM Solutions, EOS, GE Additive, Trumpf, Farsoon, BLT, HBD, Eplus, Optomec, BeAM, HP, Formlabs, Prodways, DWS, and Carbon.

About the Report

Additive Manufacturing Research’s “Core Metals” and “Core Polymers” market data products include nearly a decade of historical quarterly data and provide 10-year forward forecasts. Quarterly reports on the metal and polymer AM markets are available as a one-time or subscription purchase via AMR’s website and are customizable as needed.

AM Research’s quarterly 3DP/AM Market Insights report is available for the first time with this Q4 2023 installment.

For more information on these market data reports and other specialty market reports, please visit: http://www.additivemanufacturingresearch.com/reports

From the Report

- Momentum for AM markets in the military/government sector has further increased in Q4 to the point that it is becoming likely that government spending on AM will be the single largest market factor at play over the next two years.

- Efforts to rapidly industrialize powder bed fusion (PBF) technology and increase productivity resulted in ballooning costs and further extending the timeline for customers to gain confidence in critical application processes. Although costs per part have potential to decrease with new technologies, initial investments are still a difficult sell made only more difficult in the current financial climate for AM companies.

- AM Research believes that HP is now positioned to gain significant share in the metal binder jetting market (MBJ) and moving into a position of driving the market. HP’s association with Indo-MIM is a tell-tale sign that the market is ready for a new leader to bring metal binder jetting into a more industrial future. Still, the MBJ market was the only technology segment in metal AM to see a contraction in hardware revenues in 2023.

- Polymer AM material sales was a bright spot in the market for 2023 and is expected to intensify in 2024 as machine orders also should increase, driving further material sales. This is evidenced by companies like 3D Systems and Stratasys reporting consumables growth in 2023, while independent material developers such as BASF’s Forward AM also indicating impressive growth in 2023.