Metal 3D Printing Services: Service Revenues, Printer Purchases and Materials Consumption – 2018 to 2027

$2,497.50 – $3,497.50

| Select User License | Single User License (one computer), Group User License (Up To Five Computers), Enterprise User License (Unlimited Computers Within Your Organization) |

|---|

Request Excerpt

Table of Contents

Executive Summary

E.1 Service Bureaus and the Metals Additive Manufacturing Boom

E.2 Emerging Strategies for Metal Service Provider Evolution

E.2.1 3D Metals Printing: What’s Next in the Metals Shop?

E.2.2 Playing the Quality Card in the 3D Metals Service Bureau

E.2.3 Marketing to the Fore: HP, GE and Value Added

E.2.4 Software to the Fore: Metal Service Provider Networks

E.2.5 One Metal to Rule them All: MTI

E.2.6 Service Bureaus Give End Users the Opportunity to Try Out Printers Before Buying: Service Bureaus But Not for Their Own Sake

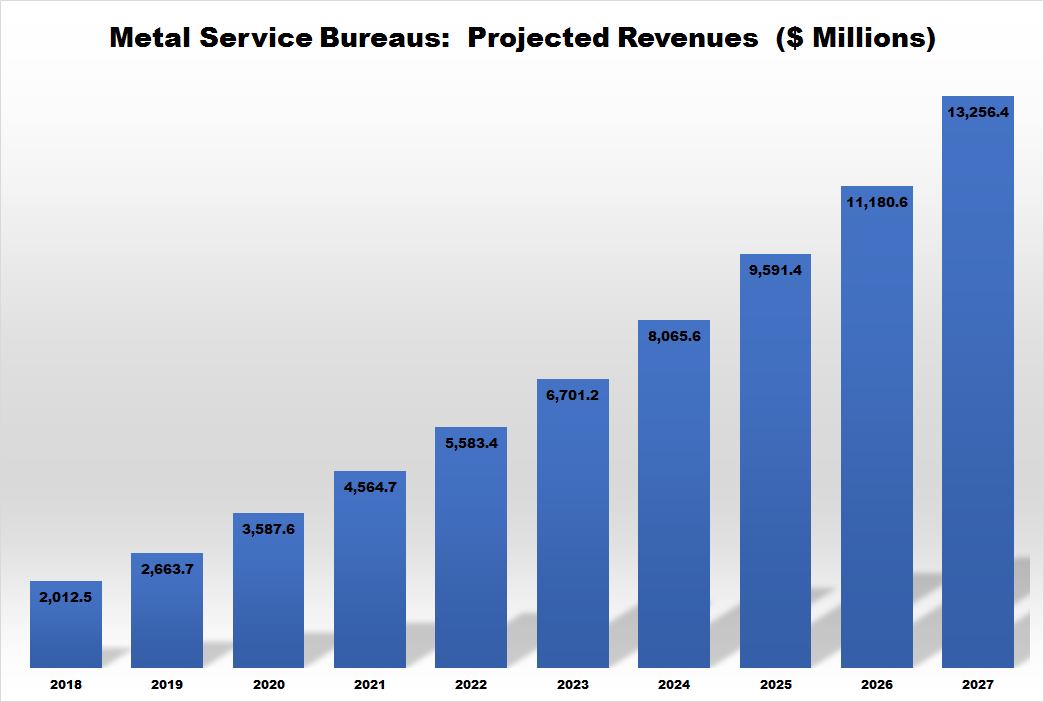

E.3 Summary of Ten-year Forecasts Contained in this Report

E.3.1 Forecasts of Service Revenue by Type of End User

E.3.2 Forecast of Service Revenue by Type of Process Used

E.3.3 Forecast by Types of Metal Used

Chapter One: Introduction

1.1 Background to this Report

1.1.1 Current Drivers for Metals Printing in the Service Provider Environment

1.1.2 Metals-oriented Service Providers: Four Types of Metal-Oriented Service Provider

1.2 Goal and Scope of this Report

1.3 Methodology of this Report

1.4 Plan of this Report

Chapter Two: Business Characteristics of Metal-Printing Service Bureau

2.1 Market Drivers, Profitability and Marketing

2.2 Adding Value with Design, Marketing and Advice

2.3 Cloud- and Hub-Based Services: Service Bureaus as an IT play

2.4 Conventional Metal Services Bureau: Marketing and Hybrid Manufacturing

2.4.1 Hybrid Metals Manufacturing: Additive Manufacturing plus Traditional Methods

2.4.2 Role of Desktop Metal Printing at Service Bureaus

2.5 Summary of Key Points in this Chapter

Chapter Three: Markets, Demand Patterns and Ten-year Forecasts

3.1 Metal AM Service Providers: Demand Structure

3.2 Demand for Metal Service Providers from the Aerospace Sector

3.2.1 Service Bureaus as Risk Avoidance in the Aerospace Industry

3.2.2 Role of Metal AM Service Bureaus and Third-Party Metals Manufacturers in the Aerospace Industry

3.2.3 Success Factors for AM Metal Services in the Aerospace Industry

3.2.4 Parts Manufactured and Companies Served

3.2.5 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures

3.3 Demand for Metal Service Providers from the Automotive Sector

3.3.1 Metal Service Bureaus for the Automotive Industry

3.3.2 Auto Parts Manufactured by Service Bureaus

3.3.3 Metal AM Materials and Machines Used in Automotive

3.3.4 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures

3.4 Oil and Gas Industry

3.4.1 Value of AM in the Oil and Gas Industry: Parts Printed

3.4.2 Components for Gas Processing and Refinery Operations

3.4.3 Impact of Non-Specialist Service Bureaus

3.4.4 Impact of Specialist Oil and Gas Service Bureaus

3.4.5 Special Considerations for AM Materials in the Oil and Gas Industry

3.4.6 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures

3.5 Medical and Healthcare

3.5.1 Implants

3.5.2 Metal Hearing Aids

3.5.3 Service Providers in the Medical AM Market

3.5.4 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures

3.6 Dental Industry

3.6.1 Additive vs. Subtractive in Digital Dentistry

3.6.2 International Differences

3.6.3 Metal Printing Technology Development Considerations

3.6.4 Printing Companies Active in 3D Printing for Milling Centers

3.6.5 Dental Metal Powder: International Distribution

3.6.6 Ten-year Forecast of Metals Service Bureau Revenues and

Expenditures

3.7 AM Metal Service Bureaus in Other Industrial Markets

3.7.1 Ten-year Forecast of Metals Service Bureau Revenues and

Expenditures

3.8 Key Points from this Chapter

Chapter Four: Strategic Analysis of Leading 3D Printing Services

4.1 3D Systems (United States)

4.1.1 On-Demand Metal Printing Services

4.1.2 Financial Implications of 3D Systems’ Service Bureau Offerings

4.1.3 SmarTech Publishing’s Perspective on 3D Systems in the Metal Service Provider Business

4.2 BeamIT (Italy)

4.2.1 Metals Orientation

4.2.2 SmarTech Publishing’s Perspective on BeamIT in the Metal Service Business

4.3 Burloak Technologies (Canada)

4.3.1 Services Offered by Burloak

4.3.2 Role of Burloaks’ Additive Manufacturing Center of Excellence

4.3.3 Important Burloak’s Alliances

4.3.4 SmarTech Publishing’s Perspective on Burloak in the Metal Service Business

4.4 Carpenter/CalRAM (United States)

4.4.1 Acquisition of CalRAM

4.4.2 Other Service Provider-related Developments

4.4.3 SmarTech Publishing’s Perspective on Carpenter in the Metal Services Business

4.5 DM3D (United States)

4.5.1 DMD Resources

4.5.2 SmarTech Publishing’s Perspective on DM3D in the Metal Service Business

4.6 ExOne (United States)

4.6.1 Services

4.6.2 SmarTech Publishing’s Perspective on ExOne in the Metal Services Business

4.7 FIT (Germany)

4.7.1 Manufacturing Sites

4.7.2 Medical Services

4.7.3 SmarTech Publishing’s Perspective on FIT in the Metal Service Business

4.8 GE Additive

4.8.1 AddWorks

4.8.2 GE Manufacturing Partner Network

4.8.3 Supply of Machines to Service Providers

4.8.4 SmarTech Publishing’s Perspective on GE Additive in the Metal Service Business

4.9 Hoganas (Sweden)

4.9.1 SmarTech Publishing’s Take on Hoganas in the Metal Service Business

4.10 HP (United States)

4.10.1 HP Enters the Metal Service Bureau Business

4.10.2 SmarTech Publishing’s Perspective on HP in the Metal Service Business

4.11 i3DMFG (United States)

4.11.1 SmarTech Publishing’s Perspective on i3DMFG in the Metal Service Business

4.12 Materialise (Belgium)

4.12.1 ACTech Acquisition

4.12.2 Automotive Services

4.12.3 SmarTech Publishing’s Perspective on Materialise in the Metal Services Business

4.13 MTI (Metal Technology Incorporated)

4.13.1 Move into Motor Sports

4.13.2 SmarTech Publishing’s Perspective on MTI in Metal Services

4.14 Oerlikon/citim (Switzerland)

4.14.1 Oerlikon End-user Focus

4.14.2 citim

4.14.3 Alliance with XJet

4.14.4 Oerlikon Print Facilities

14.4.5 SmarTech Publishing’s Perspective on Oerlikon in the Metal Services Business

4.15 Protolabs (United States)

4.15.1 3D Printing Business

4.15.2 SmarTech Publishing’s Perspective on ProtoLabs in the Metals Services Business

4.16 Renishaw (United Kingdom)

4.16.1 Renishaw Solutions Centres

4.16.2 Alliance with Infosys

4.16.3 SmarTech Publishing’s Perspective on Renishaw in the Metals Services Business

4.17 Sculpteo (France)

4.17.1 Software Strategies

4.17.2 SmarTech Publishing’s Perspective on Sculpteo in the Metal Service Bureau

4.18 Sintavia (United States)

4.18.1 Machines Owned: Installed Base

4.18.2 Alliances with Other Companies

4.18.3 SmarTech Publishing’s Perspective on Sintavia in the Metal Service Business

4.19 Siemens/Material Solutions (Germany/U.K.)

4.19.1 Metals, Customers and Products

4.19.2 AM Machines Used

4.19.3 SmarTech Publishing’s Perspective on Materials Solutions in the Metal Service Business

4.20 Stratasys Direct Manufacturing (United States/Israel)

4.20.1 SmarTech Publishing’s Perspective on SDM in the Metal Service Business

4.21 voestalpine (Austria)

4.21.1 Global AM Center Expansion at voestalpine

4.21.2 SmarTech Publishing’s Perspective on voestalpine in the Metal Service Business

4.22 Metal Service Provider Networks

4.22.1 3D Hubs (The Netherlands)

4.22.2 Hitch3DPrint (Singapore)

4.22.3 Xometry (United States)

About SmarTech Publishing

About the Analyst

Acronyms and Abbreviations Used In this Report

List of Exhibits

Exhibit E-1: Drivers for Metal Service Bureaus

Exhibit E-2: Ten-year Forecasts of Metal Service Bureau Revenues by End-User Segment ($ Millions)

Exhibit E-3: Ten-year Forecasts by Type of Machine/Process Used by Service Bureaus ($ Millions)

Exhibit E-4: Ten-year Forecasts of Materials Consumed by Metal Service Bureaus ($ Millions)

Exhibit 1-1: Metal Service Providers by Type and Motivation

Exhibit 3-1: Service Revenues from Printing Metal Parts for the Aerospace Industry: By Print Technology ($ Millions)

Exhibit 3-2: Market for Metals Used in Printing Parts for the Aerospace Industry

Exhibit 3-3: Market for Machines Used in Printing Parts for the Aerospace Industry

Exhibit 3-4: Aggregate Revenue from 3D Printing of Aerospace Parts by Geography ($ Millions)

Exhibit 3-5: Metal Parts Printed by Service Bureaus for the Aerospace Industry

Exhibit 3-6: Comparison Between Types of Metal Units Produced by External AM Services and Suppliers 2017 vs 2028

Exhibit 3-7: Service Revenues from Printing Metal Parts for the Automotive Industry: By Print Technology ($ Millions)

Exhibit 3-8: Market for Metals Used in Printing Parts for the Automotive Industry

Exhibit 3-9: Market for Machines Used in Printing Parts for the Automotive

Industry

Exhibit 3-10: Aggregate Revenue from 3D Printing of Automotive Parts by Geography ($ Millions)

Exhibit 3-11: Metal Parts Printed by Service Bureau for the Automotive Industry

Exhibit 3-12: Service Revenues from Printing Metal Parts for the Oil and Gas Industry: By Print Technology ($ Millions)

Exhibit 3-13: Market for Metals Used in Printing Parts for the Oil and Gas Industry

Exhibit 3-14: Market for Machines Used in Printing Parts for the Oil and Gas Industry

Exhibit 3-15: Aggregate Revenue from 3D Printing of Oil and Gas Parts by Geography ($ Millions)

Exhibit 3-16: Metal Parts Printed by Service Bureau for the Oil and Gas Industry

Exhibit 3-17: Service Revenues from Printing Metal Parts for the Medical Sector: By Print Technology ($ Millions)

Exhibit 3-18: Market for Metals Used in Printing Parts for the Medical Sector

Exhibit 3-19: Market for Machines Used in Printing Parts for the Medical Sector

Exhibit 3-20: Aggregate Revenue from 3D Printing of Medical Parts by Geography ($ Millions)

Exhibit 3-21: Service Revenues from Printing Metal Parts for the Dental Sector: By Print Technology ($ Millions)

Exhibit 3-22: Market for Metals Used in Printing Parts for the Dental Sector

Exhibit 3-23: Market for Machines Used in Printing Parts for the Dental Sector

Exhibit 3-24: Aggregate Revenue from 3D Printing of Dental Parts by Geography ($ Millions)

Exhibit 3-25: Ten-year Forecasts of Other Revenues Generated by Metal Service Bureau ($ Millions)

Exhibit 4-1: Materialise – Installed Base of Metals Printers

This report analyzes the opportunities and value propositions for metal 3D printing services from the perspective of the service bureaus (including specialty metal service bureaus) themselves and of printer makers, materials firms and the end user community. The coverage of this report includes:

• New directions and strategies for service bureaus.

Metal printing is challenging and expertise in this area may protect service bureau from losing business to end users who buy their own printers. Some service bureaus believe additive manufacturing is a tool that can take market share from traditional metal working firms. Will the new desktop metal printing technology create new opportunities for service bureaus?

• Metal powder firm strategies for the service bureau sector.

These strategies include both increasing sales of metal powders to service bureau and growing metal powder businesses by entering the service bureau directly

• Service bureau opportunities for traditional third-party suppliers — hybrid manufacturing strategies.

Some traditional machine shops have become early adopters of metal additive manufacturing. Metal 3D printing processes are increasingly used by third-party parts and prototype firms, leading to hybrid manufacturing arrangements incorporating 3D printing along with established processes such as casting

• The future of 3D printer makers in the metal service bureau industry.

Selling more metal machines to service bureaus, while strengthening their own metal service offerings

This report provides ten-year forecasts of metal 3D printing services provider revenues, broken out by type of service provider; along with the projections of printers, processes and the types of metals used by service providers of different types. In addition, we analyze the future goals and strategies of leading firms – including printer makers — who make metal 3DP services a major part of their business activities.